Loans can be lifelines or devastating pitfalls. Understanding their real impact empowers individuals to make choices that foster growth rather than perpetual burden. This article explores the nature of helpful loans and exposes predatory practices designed to ensnare vulnerable borrowers.

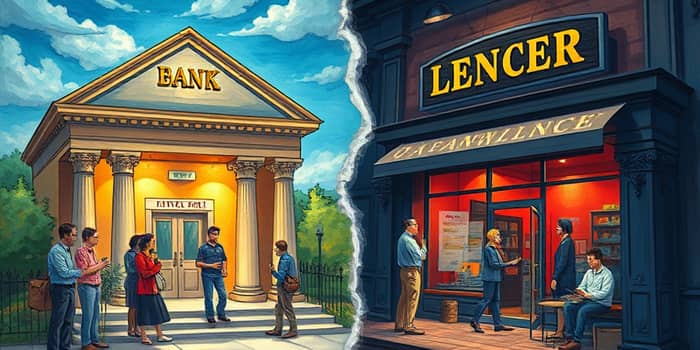

At their best, loans provide fair terms and clear disclosures, enabling investments in education, homes, and businesses. In contrast, predatory loans often impose exorbitant or hidden costs and are structured to intentionally trap borrowers in debt. Recognizing these differences is the first step toward financial resilience.

Not all loans are created equal. Some offer support and stability, while others exploit desperation and lack of options.

Helpful loans typically include:

Predatory loans exploit borrowers through aggressive fees, high rates, and unfair terms:

Predatory lenders often target those with limited options: vulnerable and disadvantaged groups including low-income individuals, minorities, women of color, the elderly, and those outside mainstream banking. These practices drain up to $8 billion annually from local economies and exacerbate generational inequality.

Repeat borrowers fuel this cycle—99% of payday loans go to repeat users, and 80% are renewed, stacking fees and compounding financial distress. Geographic areas with fewer banking services see intensified economic decline due to concentrated predatory lending.

Empowered borrowers can navigate the credit landscape safely by following these guidelines:

Regulators have implemented measures to curb predatory lending. The CFPB’s 2017 payday rule introduced a full-payment ability test and limits on repeated borrowing, encouraging safer alternatives from community banks and credit unions.

Enforcement actions by the FTC and CFPB regularly target student loan servicing abuses, debt relief fraud, and illegal online lenders. Continued advocacy and stricter oversight are critical to closing loopholes that allow rent-to-own and shadow-debt schemes to persist.

Consider Maria, a first-generation college student who financed her degree with federal student loans. Through income-driven repayment and occasional forbearance during medical emergencies, she graduated debt-manageable and launched a successful career. Her story illustrates how structured for long-term stability lending can transform lives.

In contrast, Jamal turned to payday loans after unexpected car repairs. Within months, triple-digit APRs and rolled-over debt left him owing four times the original amount. Facing repossession and mounting stress, he represents millions ensnared in cycles of destructive debt by predatory lenders.

Loans can catalyze progress or perpetuate hardship. By distinguishing between offerings built on transparent, regulated consumer protections and those designed to extract wealth, borrowers gain the power to choose wisely. Armed with knowledge and support, individuals can access credit that fuels growth, secures futures, and builds resilient communities.

References