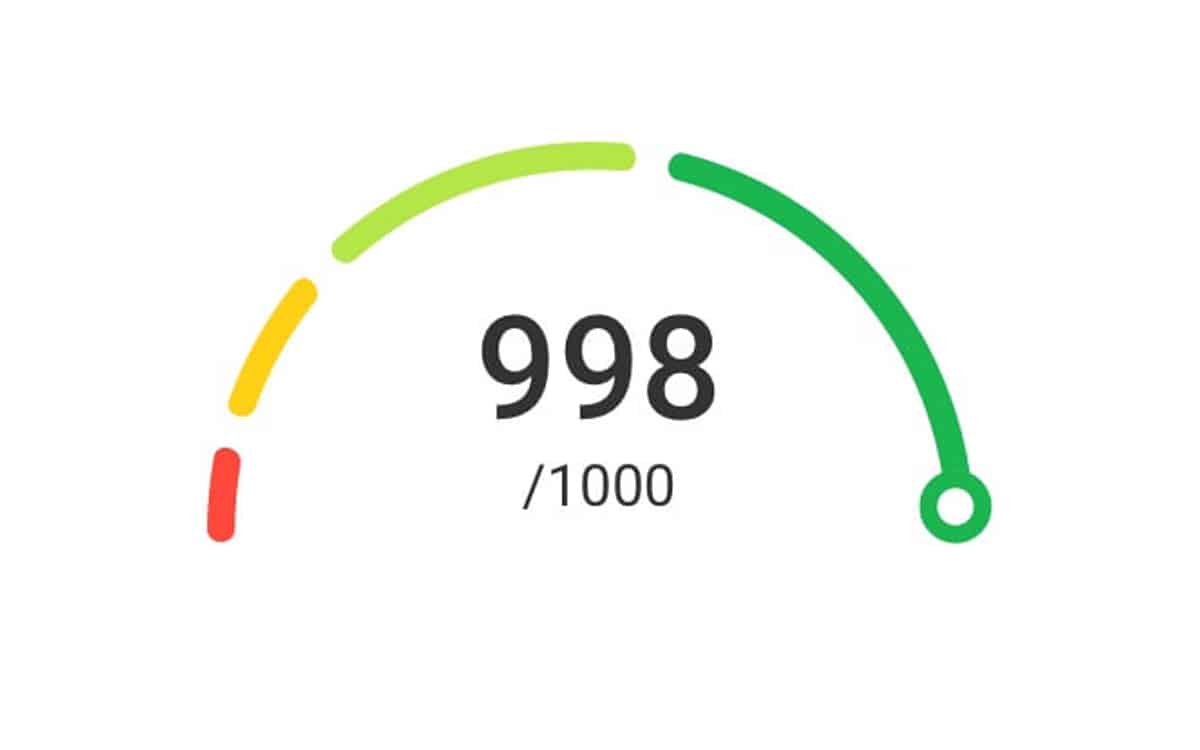

A credit score is a tool used by financial institutions to determine the likelihood that an individual or business will pay their debts on time.

A good credit score can be the key to obtaining loans with lower interest rates and better repayment terms.

However, many people are unaware of how to improve their credit score.

Understanding your credit score

Your credit score is a measure of how reliable you are about paying your debts.

If you have a good credit score, you are more likely to get loans and credit cards with lower interest rates.

If you have a bad credit score, it is more difficult to get approved for loans or credit cards, and the interest rates you are offered will be higher.

You can also check your credit report to make sure there are no errors or unnecessary negative information.

Check your credit report regularly

It is important to review your credit report regularly to detect possible errors or fraud and correct them in a timely manner.

In addition, by reviewing your report you will be able to learn about your credit history and determine areas where you need to improve to increase your credit score.

Improve your payment habits

One of the most effective ways to improve your credit score is to improve your payment habits.

Here are some recommendations:

- Pay your bills on time: make sure you pay all your bills by the due date to avoid interest charges and penalties;

- Automate your payments: Set up automatic payments to avoid missing deadlines and improve your payment history;

- Pay more than the minimum: if you only pay the minimum required on your credit cards, you will be accruing high interest charges. Try to pay more than the minimum whenever you can;

- Reduce the number of cards you use: Having too many cards can be detrimental to your credit score. Use only the cards you really need and keep balances low.

Reduce your debts

If you have a lot of credit cards with outstanding balances, try to focus on paying them off as soon as possible.

Start with the card with the highest interest rate and, once you've paid it off, move on to the next one.

Not only will this help you reduce your debt, but it will also demonstrate to the credit bureaus that you are a responsible and reliable consumer.

Another option is to consolidate your debts into one loan with a lower interest rate.

This can simplify the payment process and make it easier to manage your finances.

Don't close your credit accounts

One of the worst things you can do to your credit score is to close your credit accounts.

That's because a significant portion of your score is based on the length of your credit history and your utilization of available credit.

If you close a credit account, you are reducing the amount of available credit and shortening the length of your credit history.

Also, if you have outstanding debts on an account you plan to close, be sure to pay them off before doing so.

Use different types of credit

Using different types of credit can improve your credit history. For example, if you only have one credit card, consider applying for a personal loan or a mortgage loan.

Having different types of credit shows that you can handle different financial responsibilities and that you are able to pay your debts on time.

This will help you maintain a good credit score and get better options for future loans and credit cards.

Be patient and persistent

Finally, it is important to be patient and persevering when working on improving your credit score.

Don't expect significant improvement overnight, as changes in your score can take months or even years to be reflected.

Continue to make on-time payments, keep your credit card balances low and avoid opening new unnecessary credit accounts.

Over time, you will see an improvement in your credit score that will allow you to obtain better interest rates and more attractive loans.